At a recent Fayette County Commissioners’ meeting, a resolution was passed allowing the use of legal counsel for advice on using Refunding Bonds (also known as Jail bonds and Various Purpose Bonds) to assist with earlier pay-off of the loan for the construction of the new county jail.

The law firm being used for the legal advice is Dinsmore and Shohl, LLP/Dennis Schwallie, Esq.

According to www.investor.com, “A bond is a debt security, similar to an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. When you buy a bond, you are lending to the issuer, which may be a government, municipality, or corporation. In return, the issuer promises to pay you a specified rate of interest during the life of the bond and to repay the principal, also known as face value or par value of the bond, when it ‘matures,’ or comes due after a set period of time.”

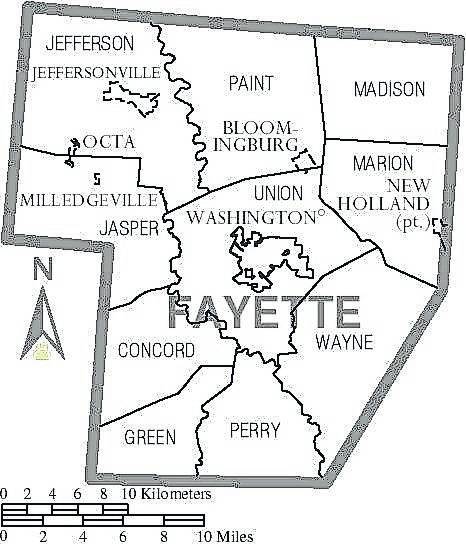

As previously reported, the new jail facility is planned to be a law enforcement complex. That complex will be located off Robinson Road in Washington Court House and will include an administrative area, a 911 call center, a detention area, an exercise area, etc.

The legislation allowing the funding for the new Fayette County Jail was passed during the May 7, 2019 special election by a 1,378-1,129 margin. The levy contained two parts — one to fund the construction and one to fund the operation of the new facility. As previously reported, the funding for the jail was a 40-year, $21,002,594 loan with a 3.5% interest rate.

After a recent change order request from Granger Construction, the company handling the construction project, the total cost is now at $21,643,189.

“At the time we (entered into the loan agreement), that was a great deal for the county,” said Fayette County Commissioner Dan Dean. “However, interest rates have taken a serious drop — partly due to COVID, but it’s just the way the economy is. The county was looking already to just issue standard bonds.”

With lower interest rates and looking into using bonds, Dean explained the payments being made on the loans will not decrease. Instead, the length of the loan will decrease.

“We’re hoping that once we sell the bonds, with the interest rate determined at the time of sell, the county will save somewhere between $6-to-$8 million dollars over the life of the loan. Which will translate into, instead of the current 40-year note, into a 32-to-33 year note,” said Dean. “Which won’t mean a whole lot to us, but it will for our grand kids — it will shorten their debt.”

According to Dean, there are local investors interested in buying the bonds as they have an interest in the community.

Commissioner Tony Anderson said, “the commission’s desire was and is to continue to work to lower the overall cost.”

Reach journalist Jennifer Woods at 740-313-0355.